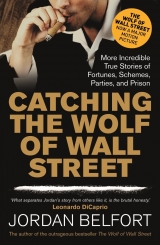

Текст книги "Catch the Wolf of Wall Street"

Автор книги: Jordan Belfort

Жанр:

Биографии и мемуары

сообщить о нарушении

Текущая страница: 16 (всего у книги 33 страниц)

“I mean, I reallythought rich people would go for that, but when I called Danny into my office, he completely disagreed. ‘Maybe if I were calling from Merrill Lynch,’ he said. ‘But not when I'm calling from Stratton Securities; there are just too many things working against me. They haven't heard of me, they haven't heard of the firm, and they haven't heard of the stock.You see what I'm saying?’

“ ‘Yeah,’ I said, ‘I see exactly what you're saying,’ and– boom!– just like that it hit me. I had my eureka moment. ‘Come back in here in fifteen minutes,’ I said to him, and before he was even out the door I had already picked up my pen and started writing a new cold-calling script. Fifteen minutes later, he was back in my office and I was explaining my new system. ‘Okay,’ I said, ‘when we call someone for the first time, we're not gonna try to sell them anything; we're just going to introduce the firm and ask them if they'd be interested in hearing from us down the road.’ I handed him my new script. ‘Read this to me and tell me what you think.’

“He looked at the script for a second, and then started reading: ‘Hi, this is Danny Porush, calling from Stratton Securities. I know you're busy, so I'll get right to the point. You probably haven't heard of us before, because for the last ten years we've been strictly an institutional block-trading firm, dealing with banks, insurance companies, pension funds.’ Danny started laughing. ‘This is classic…’

“ ‘Just shut up and keep reading,’ I said.

“He nodded and continued on: ‘However, we've recently opened up our doors to the more substantial private investor, and what I'd like to do, sir, with your permission, is send you out some information on our firm, Stratton Securities, and then get back to you down the road, next time we're making a recommendation to one of our institutional clients. Sound fair enough?’ Danny stopped and flashed me one of his famous smiles.

“Ironically, Stratton really hadbeen in business for ten years, and the only business they haddone was trading with other brokerage firms, and since brokerage firms are considered institutions, I wasn't really lying about Stratton's business being strictly institutional.” I smiled at my own twisted logic. Then I gave up my smile and said, “I won't deny that the script was a bit misleading, but that's besides the point.

“Anyway, Danny was getting about ten leads a day, and after a week it was time to execute step two of my plan, which was to start off by selling a big stock, meaning a New York Stock Exchange stock they were familiar with. That's why I chose Eastman Kodak: because of the name recognition and also because it was a very sexy story. They were in litigation with Polaroid at the time over patent infringement, and my script focused on how Kodak was sure to trade higher once the litigation settled.

“Yet, as good as my script was, Danny wasn't all that impressed. He said, ‘Even if someone buys ten thousand dollars of Kodak, my commission is only a hundred bucks. So what's the fucking point?’

“ ‘Think of it as a means to an end,’ I replied. ‘Next week, after they've paid for their trade, we'll call them back for step two.’ And, with that, Danny shrugged and walked off, spending the next ten days opening accounts on Kodak, twelve of them in all, and each for around five thousand dollars, which was a hundred shares.

“Then I called him back into my office and explained step two, which wasn't quite what he thought it'd be. ‘You mean you don't want me to get them to dump their Kodak and buy a house stock?’ he asked.

“ ‘No,’ I said. ‘I want you to tell them that everything looks great with Kodak and that they should hold it for the long term.’ I handed him a script I'd written for a company called Ventura Entertainment.” I paused, offering my captors a wry smile. “I'm sure you're all familiar with Ventura; it was the first stock we ever recommended.”

“Yeah,” said a cynical OCD. “And it was also the most overvalued entertainment stock in the history of entertainment stocks.”

I nodded sheepishly. “Yeah, but it wasn't intentional. I just couldn't keep up with the demand.” I shrugged. “But, that aside, Ventura was only a six-dollar stock back then, a tiny start-up not even listed on NASDAQ yet. It was still trading on the Pink Sheets. In truth, it could have just as easily been a penny stock, but by sheer coincidence the company's president, a man by the name of Harvey Bibicoff, had been thinking the same thing as me– namely, that a six-dollar stock sounded more valuable than a twenty-cent stock. So when he took Ventura public, he structured it with only a million shares outstanding, as opposed to the twenty million shares a typical penny stock would have.” I looked at OCD. “You follow me, I assume.”

He nodded. “Yeah; a million shares at six dollars is the same as twenty million shares at thirty cents.”

“Exactly,” I said. “On a mathematical level they're one and the same; however, on an emotionallevel they're entirely different. And as Danny stood in my office, studying the script, I knew it was perfect, especially the opening, where I transitioned from big stocks to small stocks.

“ ‘Read it to me,’ I said to him. And he nodded and started reading: ‘Mr. Jones, two reasons for the call today. First, I wanted to give you a quick update on Kodak. Everything looks great there; the stock is right where we bought it, and it looks to trade higher over the short term. There's been heavy institutional interest over the last few days, so for right now we'll just sit tight.

“ ‘And the second reason for the call is that something just came across my desk this morning, and it's perhaps the best thing I've seen in the last six months. It's one of our own investment-bank deals—a company we're intimatelyfamiliar with—and the upside is much greater than Kodak. If you have sixty seconds, I'd like to share the idea with you.’ Danny looked up and said. ‘This is fucking great! Let me give it a whirl!’

“I nodded in agreement. ‘Okay, but remember: These people are rich and sophisticated, so they're not going to fall for hype and bullshit. You use logic and reason, and massive pressure. Never forget, Danny: We—do—not—work—on—callbacks! You have only one shot with these people. So stick to the script like glue.’ With that, Danny reminded me once more that he was Danny-fucking-Porush and that he could sell oil to an Arab and ice to an Eskimo! Then he nodded and walked off.”

I shrugged. “In retrospect, it's rather ironic that I was only hoping to get a slightly bigger trade from my new system—maybe a thousand shares of Ventura, versus two hundred shares—but that was what I had in mind at the time.

“But five minutes later Danny came running back in my office, literally out of breath. ‘Jesus Christ!’ he snapped. ‘The first guy bought twenty thousand shares from me! Twenty—thousand-fucking—shares! Then he apologized to me for not buying more! He said that he wasn't liquid right now, but as soon as he was, he'd buy more. Can you imagine?’

“And that was it. In that very instant, I knew. I knew that Danny's client hadn't made a distinction between sending a hundred twenty thousand dollars to Stratton Securities and sending a hundred twenty thousand to Merrill Lynch. And it was all because we'd recommended a blue-chip stock first. Meanwhile, Danny was happier than a pig in shit, because he'd just made twenty thousand in commission. But what he didn't know was that I'd just made an additional sixty thousand dollars below the bid. And that was where the realjuice was!”

“Explain that,” said the Bastard.

“Okay, follow me for a second: Ventura was five bid, six offer-meaning that if a client wanted to buy it he had to pay six dollars, but if he wanted to sell it he could only get five dollars. That's why Danny's commission was a buck a share, or twenty thousand dollars. But Harvey was giving Ventura warrants that had an exercise price of two. In other words, Ventura was costing me only two dollars a share. All told, on Danny's twenty-thousand share block, I made sixty thousand below the bid, plus ten thousand above the bid, which was my half of Danny's commission. And all of that was from a single phone call, from a single lead. But that was only the beginning.

“I knew right then and there that if Ventura went up, and there were thousands of clients in the system, they would send in millions more.” I paused for a moment, considering my words. “Of course, it would turn out to be hundreds of millions more, but at the time I wasn't thinking that far ahead. I still had serious obstacles to overcome, not the least of which was that Harvey had only a million warrants to sell, and with my new system, I would eat through those in a matter of weeks. Then I would have to buy stock in the open market.

“But first things first, I thought; I had to shut down the ‘Old Stratton’ and retrain everyone. But I went to Mike first to tell him my plan. It sounded good, he thought, but I could tell that he definitely wasn't bowled over. ‘Give it a shot,’ he said casually. ‘However much business you bring in I can handle with no problem.’ And those were the famous last words of Mike Valenoti.

“A minute later I was standing in front of the boardroom, ready to give the meeting of a lifetime. I still remember this day like it was yesterday. ‘Everyone, hang up your phones!’ I said to the brokers. ‘Hang up your phones right now! I have something to say.’

“Most of them were right in the middle of calls, and they didn't hang up the phones at first. So I winked at Lipsky, and he rose from his chair and began disconnecting their calls in mid-pitch. Then Danny joined in the act, and a few seconds later the room was quiet.

“ ‘Okay,’ I said. ‘Now that I have your attention, I want you to gather up your leads, your pitches, your rebuttals, your client books, and anything else on your desk that relates to being a stockbroker. I want you to gather it all up and throw it right in the fucking garbage can!’

“Of course, no one did anything at first; they were too dumbfounded to move. So Lipsky started snarling at everyone. ‘Let's go! Chop chop! It's time to clean house, like the boss says!’ And next thing I knew, Danny and the Blockhead were walking around holding trash bags, and the last vestiges of the old system were disappearing before my eyes. Within minutes, there were only twelve wooden desks, twelve old telephones, and twelve obscenely young stockbrokers, dressed in varying degrees of cheap, off-the-rack suits. And they were all staring at me wide-eyed, waiting to hear what I'd say next.

“ ‘I want everyone to listen up,’ I said, ‘because what I'm about to say is going to change your lives forever. The simple fact is that all of you are going to be rich beyond your wildest dreams.’ And I went on to explain my new system to them, pointing to Danny as proof that it worked.

“ ‘How much commission did you just gross in one trade?’ I asked him.

“‘Twenty grand!’ he shot back. ‘Twenty—fucking—grand!’

“‘Twenty fucking grand,’ I repeated, and I began pacing back and forth, like a preacher, letting my words hang in the air. Then I stopped. ‘And using my new system, Danny, how much do you think you can gross in a single month? Just a ballpark…’

“He pretended to think for a moment, playing the part perfectly. ‘At least a quarter million,’ he said confidently. ‘Anything less and I'll fall on my sword!’ And with that, the room broke out into complete pandemonium.”

I shrugged. “The rest was easy. I retrained my Strattonites, using the straight-line theory. It was something that I'd come up with at the Investors’ Center but hadn't considered crucial then, because when you're speaking to poor people it's more a question of whether or not they have money to invest; if they do, convincing them is easy. But with rich people, the rules are entirely different: They dohave money to invest; it's just a question of convincing them that you're the one to invest it with. Are you smart enough? Are you sharp enough? Do you know things their local broker doesn't? Are you a Wall Street wizard, worthy of managing a rich man's money?

“That's exactly what the straight line did: It allowed a twenty-year-old kid, with a high school diploma and an IQ just above the level of Forrest Gump, to sound like a Wall Street wizard.” I paused for a moment, thinking of a way to explain the theory. “In essence, it was a system of scripts and rebuttals that allowed even the most dim-witted of stockbrokers to control a sale. It kept things moving forward, from point A to point B—from the open to the close—until a client finally said, All right, for Chrissake! Pick me up ten thousand shares! Just leave me alone!’ I know it sounds simple, but no one else had ever done this before. There were hundreds of scripts floating around Wall Street, but no one had ever organized them into a cohesive system.

“Anyway, for ten solid days I taught it to them—going back and forth, role-playing, like I'd done with Danny that night—until they knew it so well that they could recite the fucking lines in their sleep. Actually, I only spent half of each day teaching them; the other half they spent cold-calling, building a massive war chest of leads to call.

“And finally, on day ten when the leads came due, they started opening accounts on Kodak with such ease that it was literally mind-boggling. It was as if the straight line could turn even the weakest salesman into a total killer. And that emboldened me even further, and I began pounding at them even moremercilessly, promising them riches beyond their wildest dreams.

“ ‘I want you to start spending money now,’ I preached to them. ‘I want you to leverage yourselves! To back yourselves into a corner! To give yourselves no choicebut to succeed! Let the consequences of failure become so dire and so unthinkable that you won't be able to stomach the thought of it.

“‘Understand this,’ I said. ‘When Pizarro came to the New World, the first thing he did was burn his fucking ships, so his crew would have no choice but to hack out an existence in the New World. And that's what I want you to do! I want you to cut off all exit ramps, all escape routes!

“ ‘After all, you owe it to the person sitting next to you to dial the phone. You owe it to every other Strattonite sitting in this room to dial the phone. That's where our power comes from: from one another, from a collective effort, from the combined energy of a room full of the most motivated people to ever hit Wall Street, a room full of winners!’”

I paused and took a moment to catch my breath. “Anyway, you all know what happened next: Seven days later they began pitching Ventura, and all hell broke loose. Blocks of tens and twenties began slinging around the boardroom like water, and money began falling out of the sky.” I shook my head slowly. “And I can't even begin to describe how quickly we grew from this point. It was as if gold had been struck, and young prospectors began showing up in Lake Success to stake their claims. At first they trickled in, then they poured in. It started from towns in Queens and Long Island and quickly spread across the country. And just like that, Stratton was born.

“Anyway, it was only a few weeks after this when I walked into my office one morning and found Jim Taormina waiting for me. ‘Here,’ he said. ‘Stratton is yours,’ and he handed me a set of keys he was holding. ‘I'll sell you the place for a dollar and be your head trader. Just pleasetake my name off the license!’

“And then Mike came in, the old Wall Street war dog, who'd thought he'd seen everything. ‘You have to stop them!’ he begged. ‘We can't handle any more business right now. We're on the verge of blowing up our clearing agent.’ He shook his head in disbelief. ‘I've never seen anything like this, Jordan. It's absolutely incredible….’ The funny thing was that our clearing agent—meaning the company that processed our trades—couldn't handle the influx of volume and was threatening to pull the plug on us unless we slowed things down.

“And then came the Blockhead. ‘I'm underwater with commissions,’ he said, panic-stricken. ‘I can't keep track of them. Millions are pouring in, and the bank keeps calling me.’ I had put the Blockhead in charge of our finances, and he was underwater now-drowning beneath a sea of money and paperwork.

“In any event, these were all good problems, problems that were easy to handle. With Jim Taormina, I did as he asked: I bought the firm from him for a dollar and made him my head trader. With Mike, I did as he asked too: I stood before the boardroom and gave a sales meeting that turned the whole thing into a positive.

“With piss and vinegar, I said, ‘What we have here is so powerful and so effective that the rest of Wall Street can't even keep up with us!’ And, with that, my Strattonites clapped and cheered and hooted and howled. Then we spent the next two weeks just getting leads, which ultimately fueled our growth even further.

“And to help the Blockhead, I turned to my father, who was still unemployed. He was a brilliant man, a licensed CPA who'd spent the better part of his life as the CFO of various private companies. But he was in his mid-fifties now—a bit too old and way too overqualified to land a good job.

“So I recruited him—reluctantly at first, but I recruited him nonetheless. And he moved into the Blockhead's office, where the two of them had the pleasure of driving each other crazy. Mad Max quickly bared his fangs—calling the Blockhead a fucking twerp and a fucking moron and a thousand other fucking things, including, of course, a fucking blockhead. And the fact that the Blockhead was allergic to cigarette smoke was something Mad Max relished beyond belief—consuming four packs a day and exhaling thick jets of smoke right in the Blockhead's face, with the force of a Civil War cannon.

“But, that aside, you can see how I had the whole thing wired now. Between Mike and my father I had my rear flank covered, and between Danny and Kenny I had a tip of a sword that rivaled the Mossad. And I… well, let's just say that I had all the time I needed to sit back and give meetings and focus on the big picture– and to resolve the last missing piece of the puzzle, which was where to find more warrants that would provide me with cheap stock, like Ventura warrants did.”

I looked at OCD and smiled. “Care to guess who I turned to for that?”

OCD cringed. “Al Abrams,” he muttered.

“Indeed,” I said. “Mr. Al Abrams, the maddest of all Wall Streeters.” I cocked my head to the side and stared down OCD. “Correct me if I'm wrong, Greg, but I once heard a rumor that Al was writing letters to Bill Clinton about you, saying you were a rogue agent.”

OCD shook his head wearily. “He's one crazy old bird, that guy. When I arrested him, he had a hundred documents on him, some more than thirty years old!”

“Well, that sounds like Al,” I said casually. “He never liked to throw things out. He's what you call a careful criminal.”

“Not careful enough,” said the Witch. “Last time I checked, he was still behind bars.” She flashed me a devilish smile.

Yeah, I thought, but not because of you, Cruella; it was OCD who'd caught him. But I kept that thought to myself and said, “Actually, I think he's out now, probably back in Connecticut, driving his poor wife insane.” I looked at OCD. “Just out of curiosity: When you arrested him, did he have any food in his pockets? Any half-eaten Linzer tortes? He loved those.”

“Just a few crumbs,” answered OCD.

I nodded in understanding. “Yeah, he was probably saving those in case of a famine…” and I spent the next few hours explaining how Al Abrams had taught me the dark art of stock manipulation. Thrice weekly we'd meet for breakfast at the local Greek diner, where I had the pleasure of watching Al consume countless Linzer tortes, with half the torte making its way into his mouth and the other half making its way onto his cheeks and forehead; meanwhile, he would be drinking cup after cup of overcaffeinated coffee, until his hands shook.

Through it all—through all the slobbering and shaking and squeaking and squawking—he gave me the education of a lifetime. But, alas, unlike my education from Mike, this one concerned the dark side of things, the seedy underbelly of Wall Street's over-the-counter market—which was the precursor to the NASDAQ—where stocks traded by appointment, and prices were set at the self-serving whims of dark-intentioned men like Al and me.

Most troubling, I admitted, was that it wasn't long before I was teaching Ala thing or two. Within weeks, in fact, I was modernizing his rather dated stock scams—bringing my own flair and panache to them, along with the sort of brazenness that would come to characterize the Wolf of Wall Street.

By now it was a little after five, and I was finally done singing on Court Street for the day, a day that my captors considered a great success. After all, they now knew exactly how Stratton Oakmont came into existence and how—through a series of tiny coincidences and happenstances—it wound up on, of all places, Long Island.

Before I left the debriefing room, the last thing I asked the Bastard was how long he thought it would be until I actually got sentenced. Would it be three years? Four years? Perhaps even five years? The longer the better, I thought.

“Probably four or five years,” he answered. “These things have a way of dragging on sometimes.”

“That's true,” added the Witch, “and they won't be easy years. Your cooperation will be made public sometime next year, and we'll be seizing your assets accordingly.”

Now OCD chimed in, offering me a thin ray of hope: “Yeah, but you'll have a chance to start a new life. You're a young guy, and next time you'll do things right, hopefully.”

I nodded in agreement, hanging on to the words of OCD and the Bastard while ignoring those of the Witch. Unfortunately, they would all be wrong, and I would be seeing the inside of a jail cell long before that.

And I would lose everything.